What are Mobile Payments?

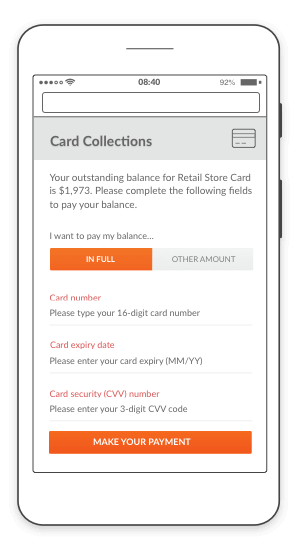

Mobile Payments by Esendex offer businesses an innovative way to collect payment from customers. With three-quarters of Australians embracing digital payment solutions but preferred to do so with non-bank apps*, Esendex’s Mobile Payments solutions enable businesses to deliver a personalised and fully branded payment environment directly to customers’ mobile devices, without the need to download any apps.

As a fully PCI DSS compliant platform and an ISO 27001 accredited provider, Esendex’s Mobile Payments technology provide both customers and businesses the confidence that payments are being made in the most secure way possible, and their data securities are being held in the highest regard, all the while providing the convenience of a self-service platform that customers can access at any time, place and on any devices.

*(Source: Roy Morgan)

Try a Mobile Payment

We’ll send a text to your phone with a link to the Mobile Payment where you can make a payment. Don’t worry – you don’t have to enter your real bank details.

An SMS is on its way with a link to the demo!

There was an error with your demo. Please call 0345 356 5758 for help.

The number entered in the box above will only be used for the purposes of this trial.

No additional information will be sent to this number.

Do Mobile Payments work?

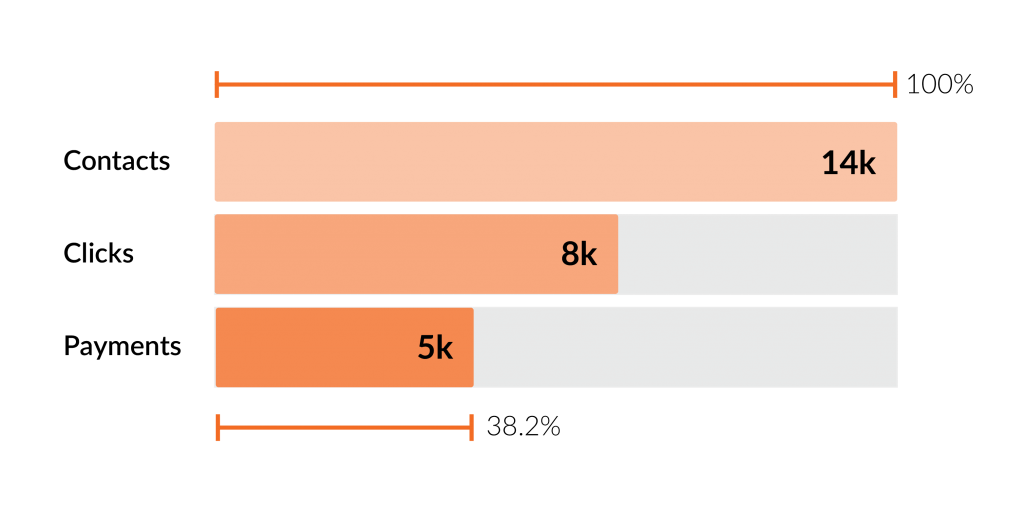

Mobile Payments are a proven way to increase payments when compared to traditional forms of payment collections like post and payments over the telephone.

We took a sample group of 14,000 customers and found that just over 5,000 (38.2%) of them went on to make a payment.

Who can use Mobile Payments?

Here are just some of the industries that can benefit from more engaging payment journeys.

Financial Services

Mobile Payments are perfect for any financial services providers to collect payment from customers. Unlike postal communications where customers have to go out of their way to take the next step; or phone conversations where customers have to engage right then and there; Mobile Payments deliver an engaging platform right to the palm of the customers for them to make payment at a time and place that is suitable for them, all via their mobile devices and without the need to speak to anyone.

Mobile Payments can be used for:

- Overdue debt reminder/payment

- Regular loan repayments

- Insurance premium collections

Public Sector

Mobile payments can help the public sector to maximise their opportunities in collecting payment, and at the same time reducing the cost related to that. With a fully automated and traceable system, organisations can enjoy the benefit of a low touch solutions yet have all the visibilities to engagement rates and data for further analysis.

Our fully PCI DSS compliant platform and ISO 27001 accreditation will give public sector the much needed guarantee for security and data protection.

Mobile Payments can be used for:

- Council tax collection

- Public housing rent collection

- Healthcare/dental treatment collection

Retail

With 48% of Australians shop via their mobile phone at least once a week*, mobile has become one of the most important touch points of the customer journey. While more and more retailers are providing contactless payment and mobile wallet for instore payment, retailers should also consider Mobile Payments for remote transactions in order to provide the best customer experience.

Combining Mobile Payments with Mobile Journeys, retailers can deliver targeted and tailored marketing and promotional campaigns while seamlessly taking payment.

*(Source: Paypal)

Mobile Payments can be used for:

- Store card collections

- Transaction processing

Utilities

Mobile Payments enable utilities providers to deliver bills directly to their customers’ mobile devices and for them to make payment at the same time, making it a much more effective and efficient process for both the customers and the providers. Instead of relying on post where communications can get lost when customers move houses, Esendex’s Mobile Payments have a proven track record of collecting unpaid bills and significantly increasing final debt payment.

Mobile Payments can be used for:

- Direct Debit setup

- Overdue payment collections

What are the features of Mobile Payments?

Here are the features which will help you collect more payments in a simple and secure way.

Integrate with leading

payment providers

Mobile Payments can be used in conjunction with your existing payment processor

Personalised

payment journeys

Include customer’s name and their unique account details for a personalised and engaging experience

Completely branded payment environments

Create a familiar payment experience with your branding

Campaign monitoring

Analyse each of your customer touchpoints with transparent reporting

Integrate with other

payment channels

Give your customers the option to pay in the channel they want to, with SMS, Email or Web channels

PCI DSS compliant platform

Have the peace of mind that credit card information will be processed, stored and transmitted securely

Don’t just take our word for it

How Cash4UNow increased their incoming payments with an automated collection service

With our Mobile Payments solution, short-term loan provider Cash4UNow is able to automate their payment collection process with a convenient self-serve platform that optimise payment collection from customers, which is a critical part of their business.

So what are the benefits of Mobile Payments?

Minimise

integration disruption

Integrate our Mobile Payments with your existing payment provider. Transition is seamless.

Increased security

Every interaction will be protected by appropriate identity verification stages

Collect more

payments

Mobile Payments have an average of 46.5% conversion rate, compared to 12.6% of the average web form

Fully automated

payments

Automating collections/payments to increase efficiency and improve effectiveness

Payments taken

around the clokc

Collect payments 24/7, without the need for any staff member

Simple to

measure success

Reports make it easy to see engagement of every touch point on the payment journey

Convenience for

your customers

Self-serve platform and mobile first experience that can be used at a time and place that best suit your customers

Reduce your cost to serve

After a low initial setup cost, Mobile Payments is more efficient and affordable than traditional routes

Want to learn more about Mobile Payments?

Let us know how we can help

Thanks for submitting your enquiry. A member of our sales team will be in touch shortly.

We’re sorry – there was a problem with your submission. Please call 1300 764 946.